-

Feb 18, 2024

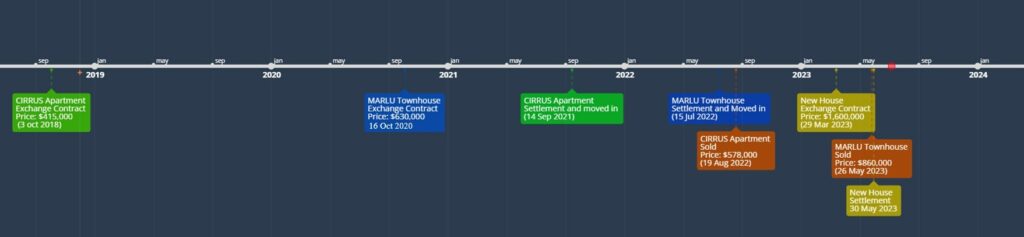

Complex Retrospective Timeline due to Multiple Purchases and Move-ins

Retrospective Property Valuation in Capital Gains Tax matters can be very complex due to the involvement of multiple transactions and simultaneous off-the-plan purchase from property owners. When there are multi-transactions occurred over short period of time, especially with the involvement of off-the-plan purchase, property owners often struggle find the precise or correct retrospective ‘Date of Valuation‘ for the assessment of Capital Gains Tax from Australian Tax Office (ATO). The issue occurred when the property owners do not know which retrospective valuation date to be assessed after multiple ‘moving in and out’.

Changing from Owner-Occupied property to Investment Property

Recently, Asia Valuation received tremendous increase volume of Retrospective Valuation works for capital gains tax purposes from property owners over Australia for the similar complex timeline. Many property owners have the similar issues. They are tempted to sell their properties due to the large profit gained during the market upheaval as a result of post-covid.

The complex issue arose when many property owners have multiple properties with different move-in dates. Theoretically, when the property owner purchased their first ‘owner occupied’ asset, they do not need to pay for Capital Gains Tax upon selling due to occupying the property as ‘place of residence’. However, when they began to purchase the second property, that is the time when they are required to pay Capital Gains Tax upon selling their first ‘owner occupied property‘ due to having a new investment property and subsequent multiple move-ins.

‘Retrospective Valuation’ Case Study from our Client

When referring to ‘retrospective timeline’ case study as per the image, we can see that despite our client purchased Cirrus Apartment on 3 October 2018, moved in the apartment upon settlement on 14 September 2021 and even sold the property on 19 August 2022. He is still obliged to pay Capital Gains Tax on the assessment of retrospective valuation date on 16 October 2020 due to the second purchase of Marlu Townhouse.

How the timeline of Capital Gains Tax is assessed and the reason behinds it

The reasons behind his splurge of Capital Gains Tax mainly due to Marlu townhouse has became his new investment property and the first property ‘Cirrus Apartment’ is no longer an off-the-plan apartment. In summary, based on this case study from our respective client, he is required to pay capital gains tax based on the retrospective valuation date on 16 October 2020 (exchange contract for second property) and sale date of Cirrus Apartment on 19 August 2022 due to the multiple purchase and move-ins.

How Asia Valuation help your Complex Valuation Matters in Tax

Asia Valuation strives to understand your complex Capital Gains Tax scenario and provide the best solutions to your problems. We provide our top-notch valuation services by listen to your situations, understand your intricate transactions, advice you based on what you need and help you in putting the numbers altogether. Asia Valuation has successful helped many Chinese clients in solving their problems and achieving their financial goals in valuation matters.